2021 Global Venture Capital Guide - Spain

World Law Group member firms recently collaborated on a Global Venture Capital Guide that covers more than 30 jurisdictions on investment approval processes, typical investment sectors and investment structures on Venture Capital deals (and more!).

The guide does not claim to be comprehensive, and laws in this area are quickly evolving. In particular, it does not replace professional and detailed legal advice, as facts and circumstances vary on a case-by-case basis and country-specific regulations may change.

This chapter covers Spain. View the full guide.

SPAIN

Cuatrecasas

1) In your jurisdiction, which sectors do venture capital funds typically invest in?

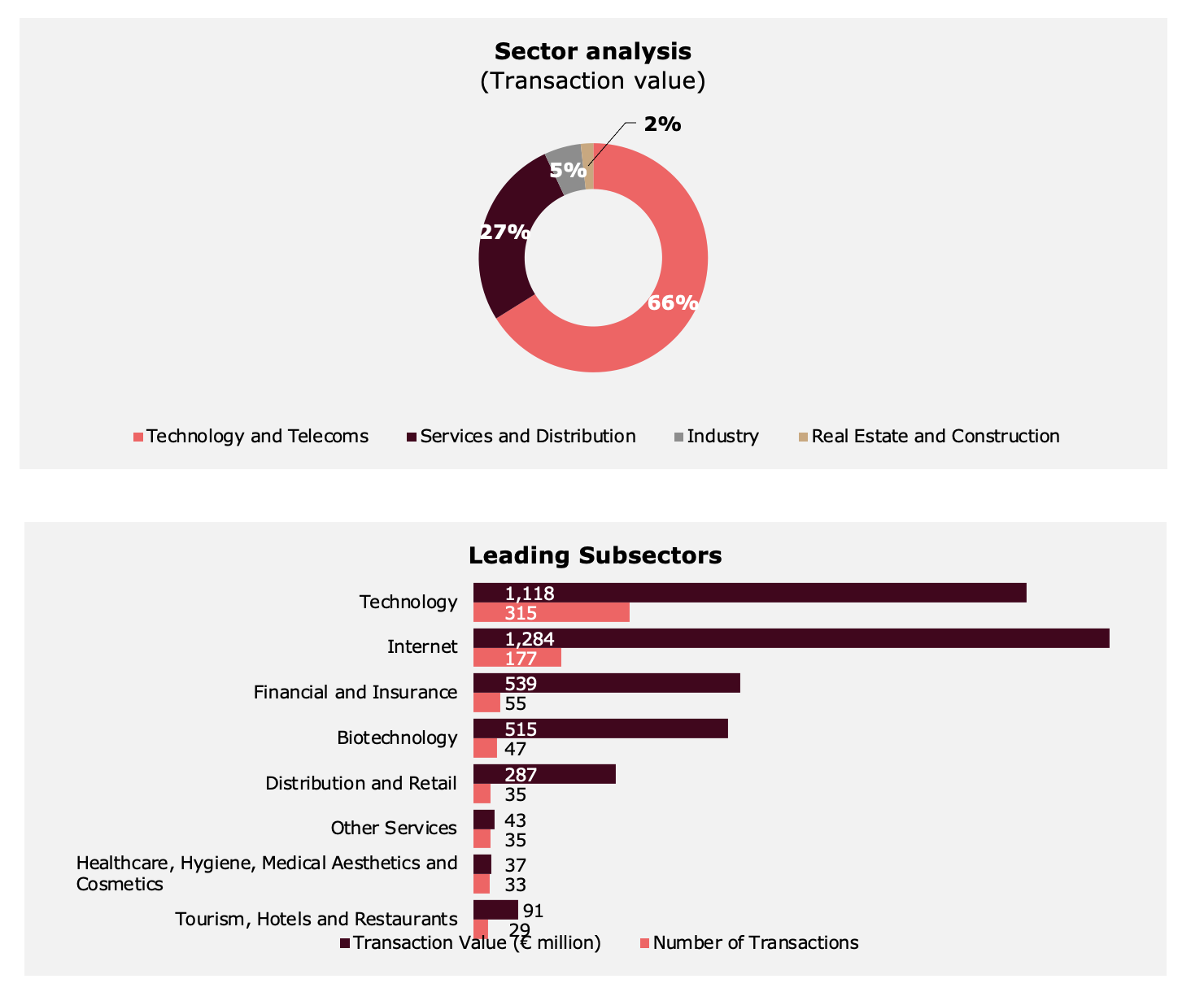

Key sectors attracting venture capital (VC) investments in Spain are clearly led by the technology and telecoms sector (66%), followed by services and distribution (27%).

According to TTR, VC deals in Spain from January 2018 to June 2019 are distributed in sectors and subsectors as follows:

2) Do venture capital funds require any approvals before investing in your jurisdiction?

2) Do venture capital funds require any approvals before investing in your jurisdiction?Foreign venture capital funds do not need to register with the Spanish Capital Markets Authority ("CNMV”) to invest in Spain. However, they must inform the Bank of Spain for statistical purposes.

If the venture capital fund is Spanish, it does not need any prior license (unlike fund managers) but it must register with the CNMV. As a matter of practice, the registration in the CNMV is not automatic, as the supervisor may require certain adjustments to the documentation of the vehicle.

As an exception, certain investments require a prior authorization as explained in question 3 below.

3) Are there any legal limitations to an offshore venture capital fund acquiring control or influencing the business, operations, or governance of an investee entity?

Foreign investments had been liberalized in Spain since 2003, with certain exceptions in specific sectors (e.g., defense). However, due to the health crisis caused by COVID-19 and following EU general guidelines, a prior authorization system has been implemented for "foreign direct investments” in two cases (with significant consequences for those investments carried out without pior authorization):

i. One based on the object of the investment (when this affects the main strategic sectors in Spain).

ii. The other based on the investor's profile (when the investor (a) is controlled directly or indirectly by a third-country government; (b) participates in sectors affecting the public order, public security, and public health of another Member State; or (c) represents a serious risk owing to its engagement in criminal or unlawful activities that may affect public order, public security or public health.)

"Foreign direct investments" are those:

i. made by (a) investors resident in countries outside the EU/EFTA; or (b) investors resident in an EU/EFTA country, whose beneficial ownership is held by a non-resident;

ii. in which the investor holds, as a result of the transaction, a share of at least 10% in the Spanish company’s capital or acquires control of it according to the terms of the Spanish Antitrust Act.

A simplified authorization system has been introduced for certain transactions that were under way and for transactions involving a small amount. Also, transactions for a value of under €1 million are exempt from the obligation of prior authorization.

As a temporary measure, until June 30, 2021, investments made in Spanish listed companies or unlisted companies (in this case, if the value of the investment exceeds EUR 500 million) by residents of EU/EFTA countries other than Spain or by residents in Spain with a beneficial owner in an EU/EFTA country will also be subject to prior authorization if the investor becomes the holder of a participation equal to or greater than 10% of the capital of a Spanish company or acquires the control of the company and the Spanish target company conducts its business in a strategic sector.

Non-resident investments that do not fall within the scope of the above "foreign direct investment” definition and do not affect restricted sectors (e.g., defense) are free, but must be reported to the State Secretary for Trade for statistical and tax purposes and to prevent infringements of law. As an exception, when investments proceed from a tax haven and exceed 50% of the share capital of the Spanish company, a prior declaration is required.

Implementing regulation on foreign investments is due to be approved in 2021 and it will have a relevant impact on the authorization of the "direct foreign investments” made by investors resident in countries outside the EU/EFTA in strategic sectors or due to the profile of the investor.

4) Would an investor be required to undertake an antitrust analysis prior to investment? When would such a requirement be triggered?

The Spanish Law for the Defense of Competition requires prior notification and authorization for mergers and other concentrations, including acquisitions and full-function joint ventures, which are not notifiable to the European Commission under the EU Merger Regulation, but which satisfy the thresholds below.

Parties to a concentration must notify the National Commission for Markets and Competition when either of the following alternative sets of thresholds is met:

i. A market share equal to or above 30% in the relevant product or service market in Spain (or in a geographical market defined within Spain) is acquired or increased as a result of the transaction (unless, under a de minimis exemption, the annual Spanish turnover of the acquired undertaking or assets does not exceed EUR 10 million (approximately USD 11.8 million) and the undertakings concerned have no individual or combined market share of 50% or more in any affected market in Spain or in a geographic market within Spain).

ii. The combined aggregate turnover in Spain of all the undertakings concerned in the transaction exceeds EUR 240 million (approximately USD 283.4 million) in the last financial year and the aggregate turnover in Spain of each of at least two undertakings concerned exceeds EUR 60 million (approximately USD 70.9 million).

5) What are the preferred structures for investment in venture capital deals? What are the primary drivers for each of these structures?

When a VC fund invests the target needs new funds to develop the business plan through different funding rounds. Therefore, the most typical transaction is that the VC fund acquires a minority shareholding in the target company (usually around 10-20%) through a capital increase by means of contribution in cash. This contrasts with private equity (PE) transactions, where PE funds usually buy 100% of the capital stock (or a wide majority) of a more consolidated target company or take a majority shareholding through a pure share purchase deal.

In some cases, VC funds also subscribe to convertible notes. The advantage of this structure is that the target receives funds immediately while the investor may decide its form of investment at a later stage. The

conversion rate and the main terms and conditions of the future shareholders’ agreement are usually agreed on in the convertible note agreement.

While determining the preferred structure, tax implications must be considered in each case.

6) Is there any restriction on rights available to venture capital investors in public companies?

There is no restriction. Securities regulations in Spain apply uniformly to all investors and shareholders of a public company, regardless of where they are resident. However, VC funds tend not to invest in listed companies.

Securities regulations in Spain (implementing the EU Takeover Directive) provide for two types of takeover bids (TOB) related to the acquisition of a controlling interest in a listed company: (i) those triggered by acquiring control of a listed company (mandatory bids), and (ii) those voluntarily launched by a bidder to acquire shares in a listed company through a public offering (voluntary bids).

For TOB purposes, control of a listed company is gained when a shareholder acquires (i) 30% of the company’s voting rights; or (ii) a stake of less than 30%, provided it appoints, within 24 months, a number of board members that, added to those it had already appointed, make up more than half of the company’s board members. Control can be achieved not only by direct or indirect acquisition of securities conferring voting rights, but by reaching agreements with other holders of securities that will lead to the acquisition of 30% of the voting rights by consensus.

Acquiring control of a listed company does not always trigger a mandatory bid. There are certain legal exceptions and situations where the CNVM will waive or can waive the obligation to launch an offer (e.g., counterweight shareholders, rescue operations or mergers).

7) What protections are generally available to venture capital investors in your jurisdiction?

It is market practice in Spain to include some contractual provisions in the investment agreement to protect investors. The most used are (i) de facto vetoes (or request of reinforced majorities taking into account the classes of shares) for key resolutions of the governing bodies; (ii) a right to propose directors or observers of the board of directors; (iii) strong rights of information; (iv) tag-along and drag-along clauses, (v) right of first offer or preemptive acquisition right clauses; (vi) anti-dilution rights (economic compensation in case a new investor acquires new shares of the target for a lower price than the one paid by the investors); (vii) economic rights in case of a liquidation event; and (viii) founder’s post-closing covenants regarding permanence, exclusivity and non-competition.

Some of the contractual provisions can be transferred to the company bylaws, strengthening the position of the investor who may not only claim a contractual breach, but also challenge a corporate resolution contrary to the bylaws. This can be done through the inclusion of (i) ancillary obligations of fulfilling the obligations established in the shareholders’ agreement; (ii) different classes of shares giving their owners different rights in certain circumstances (i.e., a liquidation preference in a liquidation event or the possibility to propose directors); (iii) stronger rights of information; or (iv) creating de facto vetoes through bigger percentages of votes for key resolutions of the governing bodies.

An investor can also (i) challenge a resolution that damages the corporate interest to benefit one or more shareholders or third parties (damage to the corporate interest also occurs if the majority imposes a resolution abusively, even if it does not damage the corporate assets), or (ii) bring an action for liability against a director who has breached his or her duties of diligence and loyalty to the company (i.e., in case of mismanagement, but consider that directors are protected by the business judgment rule under Spanish law).

8) Is warranty and indemnity insurance common in your jurisdiction? Are there any legal or practical challenges associated with obtaining such insurance?

Although the VC market in Spain is currently very active, it has not seen big exits yet compared to other jurisdictions. Therefore, the use of W&I insurance in VC is still low and investors rely on contractual remedies for breach of R&Ws as the buyer’s only remedy.

However, if we focus on the Spanish M&A market in general, since 2016, the use of W&I insurance has increased considerably. W&I insurance has become important in the PE sector, as it allows the PE fund to make a clean exit while disinvesting.

W&I insurance coverage depends on the policy negotiated, but usually it does not include (i) matters the insured party has actual knowledge of (i.e., matter discovered during the DD process); (ii) matters outside the DD scope; (iii) anti-bribery, anti-corruption, anti-money laundering, and anti-tax evasion warranties; (iv) fines and penalties (at least criminal penalties); (v) purchase price adjustment and locked-box mechanisms; (vi) forward-looking warranties; (vii) environmental liability; (viii) transfer pricing, and joint and several tax liability for belonging to a corporate group; (ix) asset’s condition; (x) product liability; and (xi) seller’s covenant or commitment related to managing the business during the interim period.

The policies are usually buyer-side policies. Seller-side policies do not tend to be the best option because of the general exclusion of actual knowledge. However, sellers often want to control and shorten the process. That is why sometimes there is a "seller-to-buyer flip,” meaning the seller starts the process of negotiating the policy, but the purchaser finalizes it. This is common in auction processes.

Usually, when W&I insurance is taken out, the seller makes a clean exit (i.e., he or she does not grant any business warranty), meaning the purchaser has no action against the seller. However, in a clean exit, it is common for the purchaser to have an action against the seller in cases of fraud, willful misconduct and breach of fundamental warranties.

9) What are common exit mechanisms adopted in venture capital transactions, and what, if any, are the risks or challenges associated with such exits?

The main exit mechanisms VC funds use in Spain are (in this order of frequency):

i. Sale to a third party, which can be: (a) a trade sale (sales to industrial entities), or (b) a sale to another PE fund (secondary buyouts or SBO);

ii. shareholders repurchase of shares (buybacks); or

iii. IPOs.

The reasons that make the sale to third parties (trade sales or SBO) the main exit strategy compared to IPOs are mainly that (i) it is sometimes the only option for small investments; (ii) the transaction is executed in less time, as it is outside the scope of the regulator's supervision; and (iii) the transaction costs are lower.

Buyback agreements can also be implemented quickly and can have even lower transaction costs than a sale to a third party, but the relationship between the founders and VC investors may turn complicated if the business does not develop as expected, since the VC investors have already guaranteed their exit with a minimum return. Also, through the sale to a third party, the VC fund has (i) the possibility of obtaining a higher valuation of the shares or assets; and (ii) the possibility of obtaining an exit of 100% of the investment.

The sale to third parties (trade sale or SBO) are usually implemented through the regulation in the shareholders’ agreement of a selling order to an investment bank (usually run as an auction) or a drag-along clause.

Buyback agreements are usually implemented through a put option on the founders. The buyback of shares by the target company is hardly seen due to the legal limitations on treasury stock for limited liability companies under Spanish law.

The IPO process is explained below.

10) Do investors typically opt for a public market exit via an IPO? Are there any specific public market challenges that need to be addressed?

In Spain, exiting through an IPO is starting to be considered by VC investors, but is still not as common as within the PE sector.

Only public limited companies (sociedades anónimas) can be listed. Therefore, usually, the target will need to be converted from a limited liability company (sociedad de responsabilidad limitada) to a public limited company.

The structure of the IPO will be influenced by a whole range of factors, including (i) the size of the company, (ii) the nature of its business, (iii) the reasons for going public (e.g., company wants to raise equity finance or existing shareholders want to realize part of their investment), or (iv) the market’s entry requirements. The IPO will usually be led and managed by an investment bank, which will issue a report analyzing the target’s suitability to make the IPO and provide the target with a specific proposal, including recommendations on (i) the structure, timing, type and geographical distribution of the addressees of the IPO; (ii) the best market on which to list its shares; (iii) the target’s valuation rank and its estimated post-IPO market valuation, including the minimum return the investors will obtain; or (iv) the target’s capital structure after listing and its corporate governance.

In Spain a company can choose to be listed on the regulated market (the Spanish Stock Exchanges) or on the alternative equity market (the MAB). The latter is a multilateral trading facility developed to meet the needs of smaller companies that might not meet the full criteria of a listing on the Spanish Stock Exchanges (e.g., free float requirements or market capitalization) or that need a more flexible regulatory environment.

Before listing the company, the shares can be offered to the public for subscription (if they are newly issued shares), for sale (if they are existing shares), or for both. An offer prospectus will be required before making such offer to the public. Alternatively, the shares can be offered to a select base of institutional investors within a private placement and no prospectus is required. Before an issuer can request admission to trade on the Spanish Stock Exchanges, it must file a listing prospectus.

There is a single rule throughout the EU governing the content, format, approval, publication and exemptions to offer and list prospectuses.

Cuatrecasas

Diana Rivera

diana.rivera@cuatrecasas.com

Want to Learn More?

View Other Country Responses and the Full Venture Capital Guide

The objective of this publication is to serve as a Q&A-style multi-jurisdictional guide to venture capital law in countries where WLG member firms have offices. The guide intends to provide a high level overview of the venture capital market, including key sectors, preferred investment structures, regulatory approval requirements, limitations on acquisition of control in portfolio companies, restrictions on investment, investor protection, and exits; and hopes to provide readers the benefit of the shared global knowledge and local insights among the WLG member firms.